[ad_1]

If we let students graduate high school without learning key skills like saving and budgeting, we’re doing them a real disservice. These budgeting activities are terrific for a life-skills class, morning meeting discussion, or advisory group unit. Give teens the knowledge they need to make smart financial choices now and in the future.

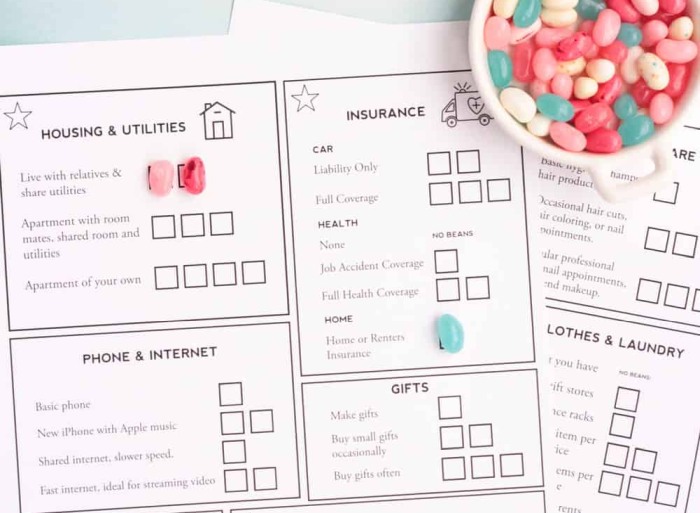

1. Try the Jellybean Game

Before you get into the nitty-gritty of numbers, start with this clever activity that gives kids practice allocating assets in a low-stakes way. They’ll use jellybeans to decide what they need, want, and can truly afford.

Learn more: The Jellybean Game/Pretty Providence

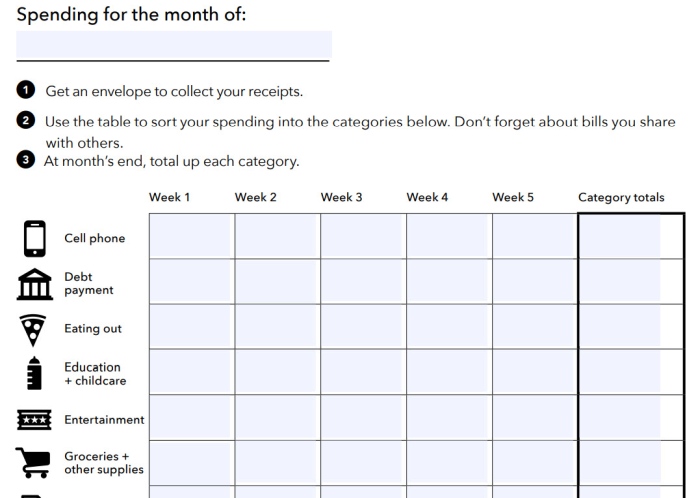

2. Use budget-planning worksheets

The Consumer Financial Protection Bureau has developed lots of tools to help teens and adults learn to manage money. Show kids how to use their Income Tracker, Spending Tracker, Bill Calendar, and Budget Worksheet (all at the link below). Start by having kids consider their current financial situation. Then, give them hypothetical “adult” situations to plan for, with income and expenses drawn from typical people in your area.

Learn more: Budgeting Worksheet Tools/CFPB

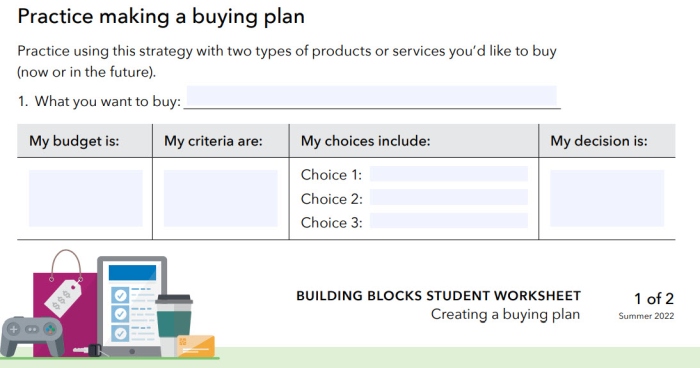

3. Create a buying plan

This activity encourages kids to think about purchases, especially major ones. Saving money is just one part of the process—they also need to consider what makes a good purchase, and whether they should pay up front or borrow the money instead.

Learn more: Create a Buying Plan/CFPB

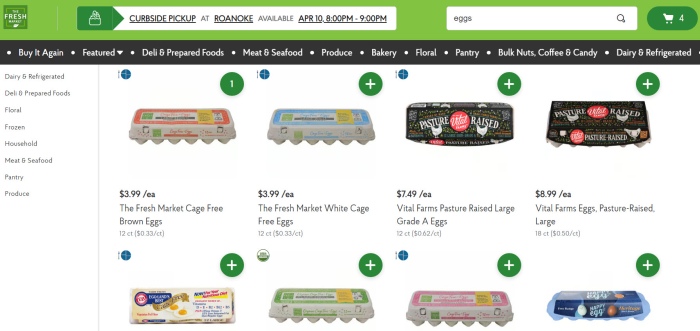

4. Practice grocery shopping

Most kids probably have no idea how much groceries cost. Use grocery store websites to your advantage, and have kids take a virtual “shopping trip.” They can plan meals and determine what they’ll need to buy. Or have them start with a weekly food budget and work backwards from there. Either way, remind them to make sure their menus include healthy options.

Learn more: Make a Healthy Grocery List/WebMD

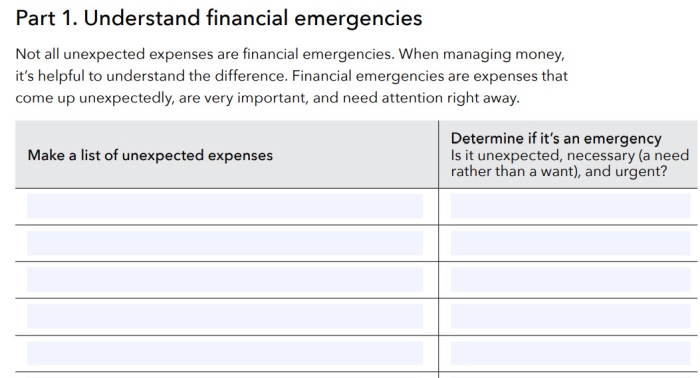

5. Build a savings “first-aid kit”

It’s no secret that things can and do go wrong. Budgeting activities like this one help students learn what to do when unexpected expenses crop up. Students learn about real-world costs and come up with ways to save in advance and adjust on the fly.

Learn more: Savings “First Aid Kit”/CFPB

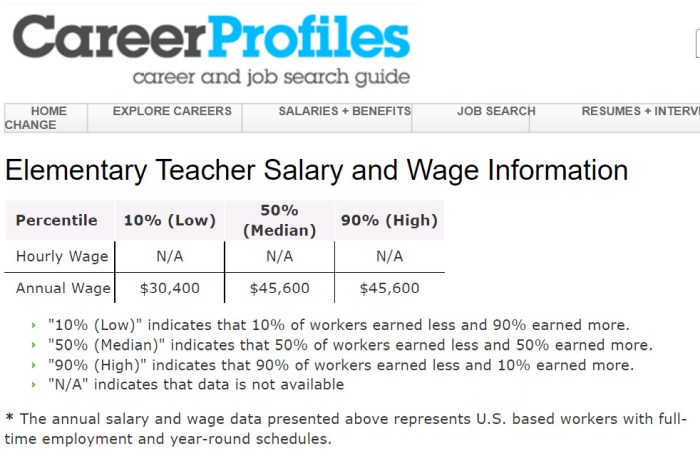

6. Discover what jobs actually pay

Ask students to list some jobs they think they’d like to do someday. Then, have them research average salaries for those jobs. Encourage them to factor in where they plan to live (salary ranges can be dramatically different across the country). Plus, ask them to think about the education they’ll need to land those jobs, and how long it will take them to earn the money to pay back any loans they’ll have to take.

Learn more: Career Profiles Job Salaries by Field

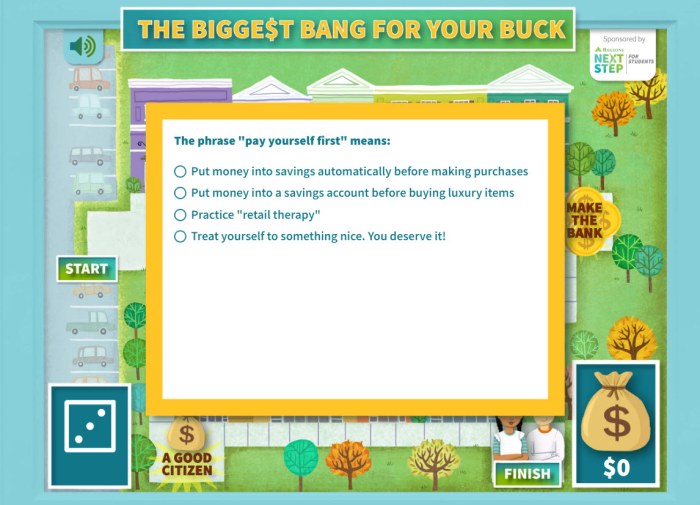

7. Play The Biggest Bang for Your Buck

This online game guides kids through a shopping trip, with financial literacy questions along the way. It’s simple but a terrific way to introduce a discussion on spending, saving, and budgeting.

Learn more: The Biggest Bang for Your Buck

8. Find out how credit cards work

Source: Investopedia

These days, most people pay with plastic instead of cash. Sometimes they use debit cards, but often they’re credit cards. If you’re going to use them, you need to know how they work. Divide your class into groups, and ask each to research a different question about credit cards, like how they work, what interest they charge, and how to use them safely.

Learn more: Credit Card Basics/Money Under 30

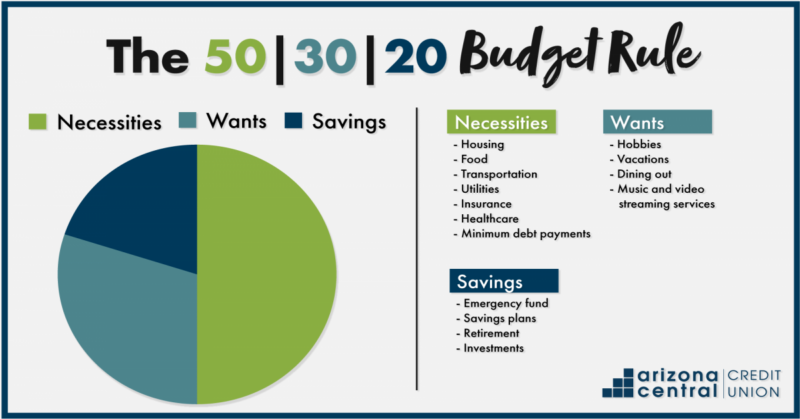

9. Experiment with different budget models

Source: Arizona Central Credit Union

There’s no one right way to set up a budget. Expose students to a variety of models, like proportional budgets, the “pay yourself first” model, the envelope budget, and more. Ask them to think about which kind of person each model works best for, and which one they’d choose.

Learn more: 6 Different Budgeting Methods/Young Adult Money

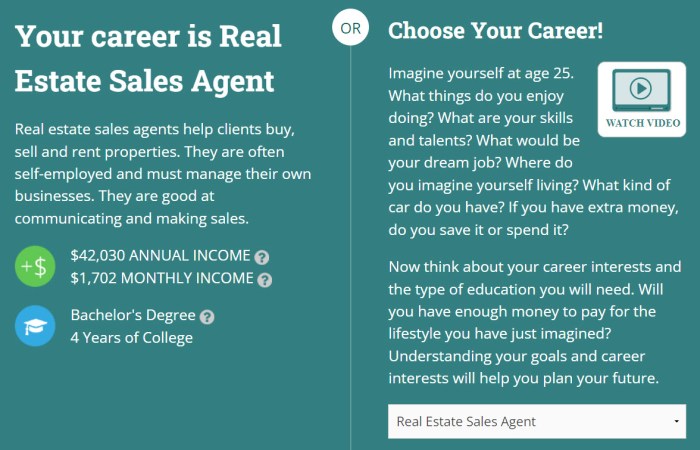

10. Claim Your Future

This cool online game assigns you a career (or lets you choose one) and tailors your experience to your location. You get to make choices about housing and other expenses, and the game calculates how those things fit into a responsible budget.

Learn more: Claim Your Future

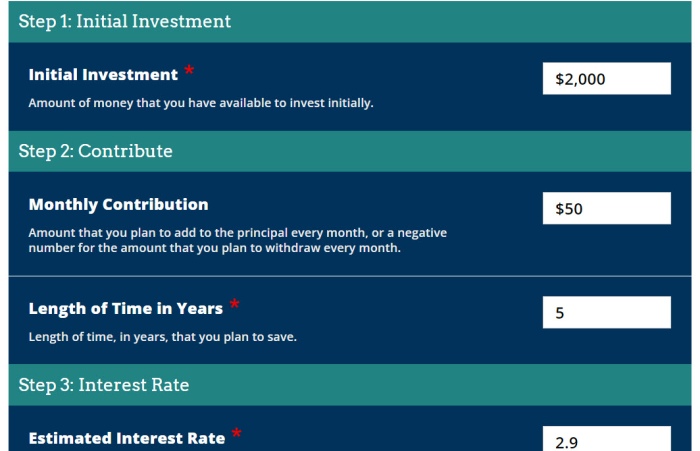

11. Calculate compound interest

When you invest your money in an interest-bearing account, it earns money just by sitting there! That money can really grow over time too. Have students complete budgeting activities like looking up current interest rates and then calculating the potential interest from using those accounts for short and long periods of time. Explore local bank offerings, and take into account things like fees too.

Learn more: Compound Interest Calculator

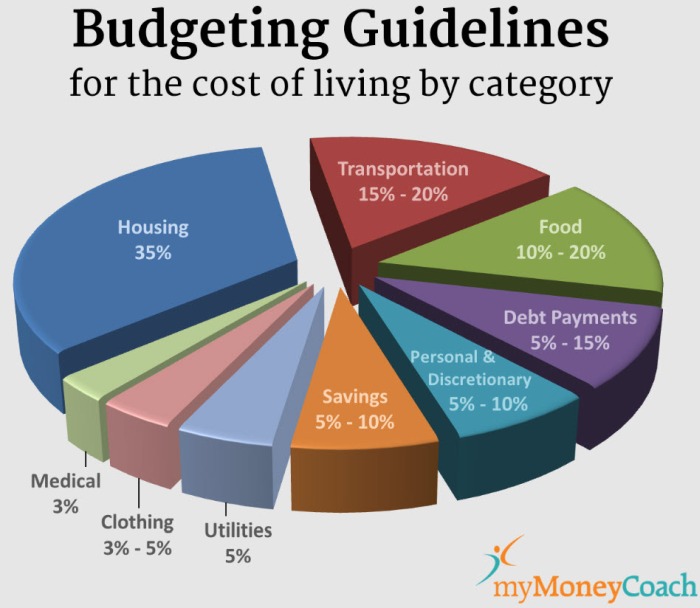

12. Learn what “living expenses” means

Source: My Money Coach

Kids generally don’t think about all the costs of daily living. Start by brainstorming a big list as a class of all the things people need to spend money on each month: rent or mortgage, car payments, credit card payments, food, entertainment, utilities, internet access, and more. Break kids into groups and have each group research the average costs of those items in your area. Come back together as a class and add up their findings to see what “living expenses” can really be.

Learn more: Monthly Expenses/Inspired Budget

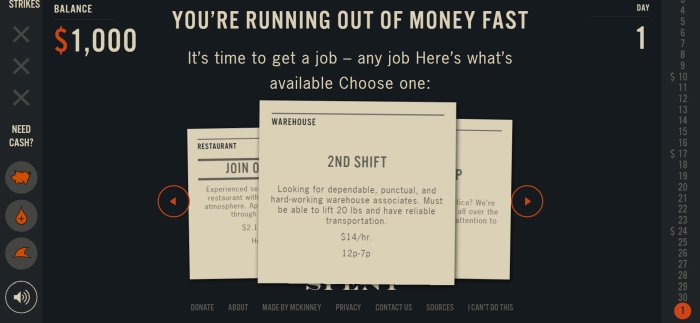

13. Survive on a limited income

Living on the financial edge is a sad reality for so many people. Show kids what that can feel like with this online simulation. When the game starts, you have no housing and no job, and just $1,000 in the bank. Can you get a job and make it to the end of the month?

Learn more: Spent

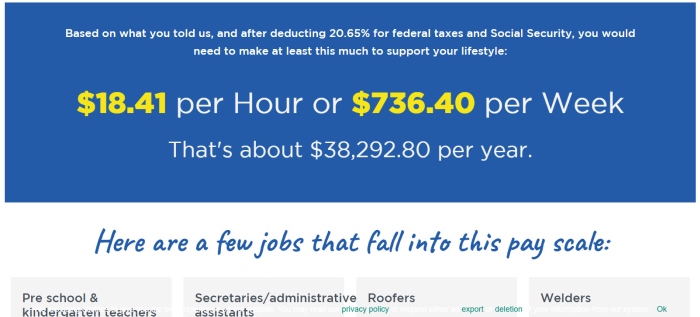

14. Get a reality check

Everybody’s got dreams, but how realistic are they? That’s where the Jump$tart Reality Check program comes in. By making choices about the future they want, teens will learn what they’ll need to earn to make it happen. The answers might really surprise them.

Learn more: Jump$tart Reality Check

15. Have a Misadventure

This online game feels a bit like a graphic novel, and it helps kids learn the basics of budgeting and money management. Explore multiple topics and complete missions to learn valuable skills.

Learn more: Misadventures in Money Management

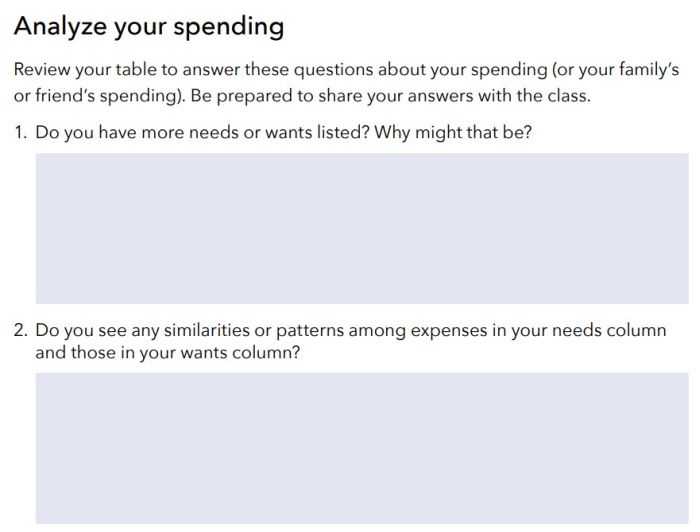

16. Reflect on needs vs. wants

Ask students to reflect on what they truly need to survive vs. things that just make life easier or more fun. Budgeting activities like this can help them identify items they can eliminate when funds get really tight.

Learn more: Needs vs. Wants/CFPB

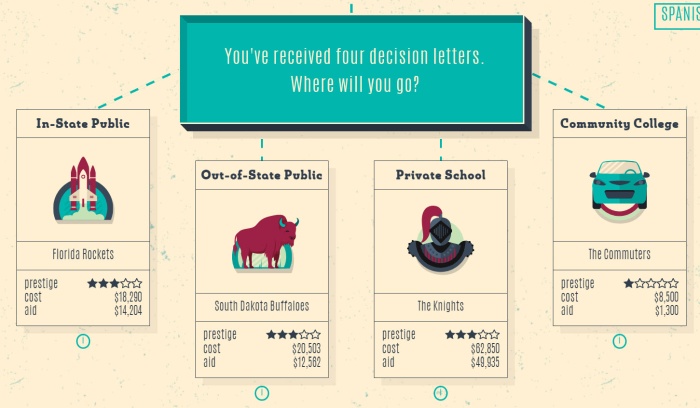

17. See the true costs of college

College-bound kids might figure they’ll take loans now and figure out how to pay them back later, but do they really have a handle on the true costs? These interesting online simulations let you pick your school, then walk through four years of potential expenses and income opportunities to find out how you fare in the end.

Learn more: Payback

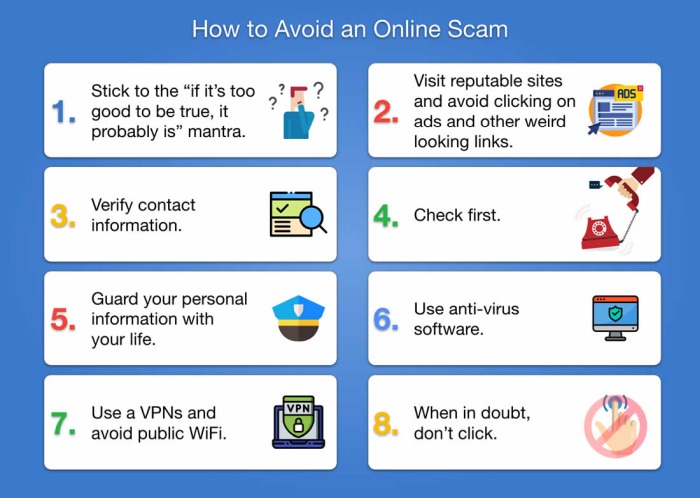

18. Learn to protect your money

Source: Broadband Search

If teens don’t learn smart skills like avoiding phishing scams, how to choose good passwords, or identifying fraudulent sites, they can lose everything they save. Take time to learn about the most common fraud issues, and teach them how to be responsible online.

Learn more: 8 Ways To Protect Your Money That All Students Should Know

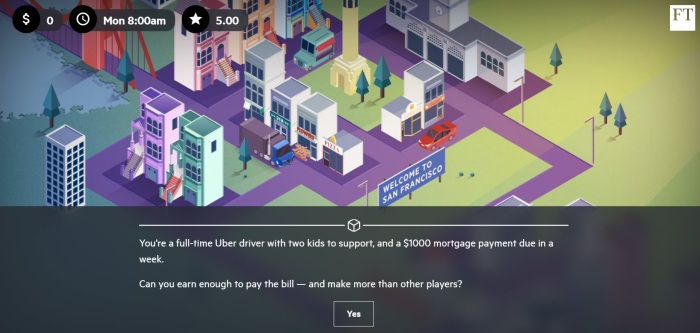

19. Make a living in the gig economy

Let students imagine life as an Uber driver. This game is based on actual Uber driver experiences and can be a real eye-opener.

Learn more: The Uber Game

20. Hit the Road

Think of this like Oregon Trail for the modern age. A group of friends is setting off on a cross-country trip, but they’ve got to manage their funds to get where they want to go. Try this one as a group activity so kids have to work together to make smart choices.

Learn more: Hit the Road

Budgeting activities are just the start! Check out these 24 Life Skills Every Teen Should Learn.

Plus, get all the best teaching tips and ideas straight to your inbox when you sign up for our free newsletters!

[ad_2]

Source link